Internal auditors provide an unbiased opinion and independent view on the efficiency, economy and effectiveness of business operations. We report to the highest level in the orginisation : senior managers and governors. This helps the top management to steer the entity during strong storms of volatile business environment. We are effective in conducting internal audit and we deploy the task to qualified, skilled and experienced people of our firm who can work in accordance with the Code of Ethics and the International Standards. We look beyond financial risks and statements to consider wider issues such as the organisation’s reputation, growth, its impact on the environment

Importance :

- Assess and manage the risk

- Act as a part of management to improve internal control

- Assess control at all level of organization and provide guidance to make it more effective

- Analyzing operation and the element of economy efficiency and effectiveness

- Assess the correctness of information reported to top management

- Protection and safeguard of asset along with its use

- Ensure compliances with all the prevailing and applicable laws and regulations.

Why we :

Kaloti & Lathiya, a chartered accountancy firm in Amravati providing services of internal audit all over the Maharashtra as well as in Goa to private sector companies, and even public sector undertakings (government owned entities). We have six branches all over India. During internal audit we take care of companies financial as well as non financial aspects. This will include management reporting cash flows internal control at all level of operation, compliance with prevailing laws and regulations; consider the risk of fraud and fraud risk factor, etc.

By reporting to executive management the important risks that have been evaluated and highlighting where improvements are necessary, we help executive management and board to demonstrate that they are managing the organisation effectively on behalf of their stakeholders.

Safeguarding of assets, adequate division of authority over key control areas and compliance with internal operating policies and guidelines are other focus areas of our procedures. We work to ensure that assets of entity are used in such a way that they provide the atmost benefit to entity and every expenditure is incurred considering the economy and propriety elements.

Legislative requirement :

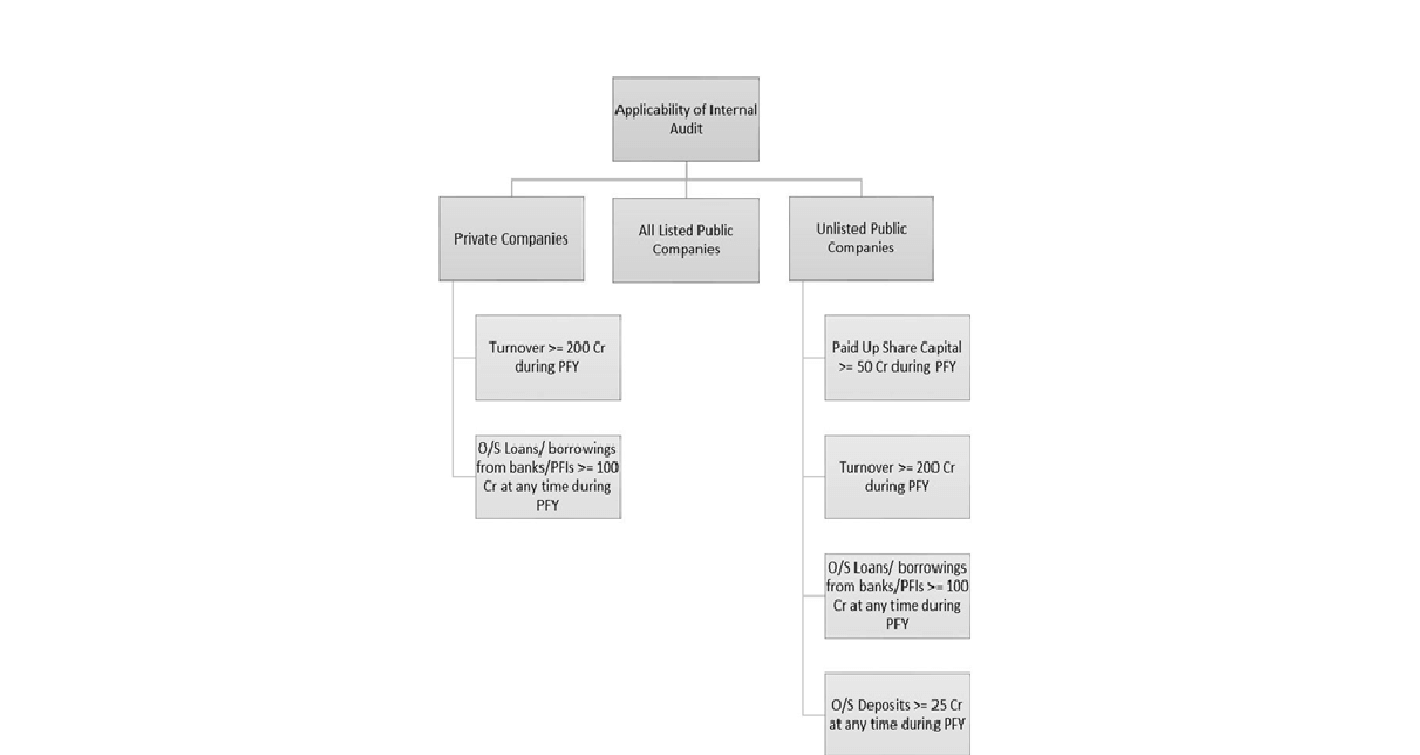

As per section 138 of companies act 2013 read with rule 13 of companies (accounts) rule 2014 internal audit is compulsory for following companies:

Penalty :

The company and every officer of the company who is in default or such other person shall be punishable with finewhich may extend to ten thousand rupees, and where the contravention is continuing one,with a further fine which may extend to one thousand rupees for every day after the first during which the contravention continues.